Support And Resistance In The Forex Market

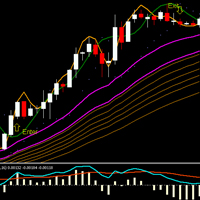

When the Forex market moves up and then drops back down some, the highest point that it has reached before the drop down is now resistance. As the market goes back up again, the lowest point that it reached before it starts to climb again is now the support. An uptrend line, in it’s most basic form, is drawn along the identifiable valleys, or support areas. A downtrend line is drawn along the identifiable peaks, or resistance areas.

To create an ascending channel, you just draw a line that is parallel and that is the same angle as an up trend line, and then simply position the line to where it touches the most recent resistance level. With a descending channel, you just move the parallel line to where it touches the most recent support level. When the market passes through the resistance point, that resistance becomes the support. The more often that the price tests a level of support or resistance without breaking it, the stronger that area of support or resistance becomes.

Support and resistance are one of the best known and widely used Forex trading concepts and strategies in the Forex market. It is important to remember that the support and resistance levels are not actually exact numbers. Sometimes support or resistance levels may appear to be broken but it soon becomes apparent that the market was just testing it. Candlestick charts show shadows that represent these support and resistance levels. Support and resistance levels are usually considered broken if the market actually closes past that specific level.

To help market traders weed out the false breakouts, support and resistance levels should be considered zones instead of exact numbers. Finding these zones is a simple matter of plotting the support and resistance on a line chart instead of a candlestick chart. Line charts will show only the closing price, without the highs and lows that the candlestick chart shows.

These extreme swings can sometimes be misleading and cause Forex traders to falsely react to the market. Plotting support and resistance should only consider the intentional movements of the market, not the reflexes of the market.

Using support and resistance to trade in the Forex market is considered smart by most Forex traders. However, these should be considered zones and not actual exact numbers. Support and resistance levels are an important concept and strategy when trading on the foreign currency exchange. Forex traders use resistance and support levels to help them understand market trends and to maximize their profit potential while minimizing their risks. These are just two of the many tools that are available to Forex traders to help them understand the Forex market.