The Forex Market: Divergence Trading

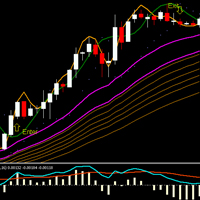

Divergence trading is one type of trading in the Forex market. Divergence basically means a price action measured in relationship to an oscillator indicator.The type of oscillator used does not really matter, and some types that may be used include Stochastic, RSI, CCI, MACD, or others.

Divergences can be used as a leading indicator, and after you have some practice with divergences it becomes easy to spot changes. When divergences are traded properly, there can be consistent profits to the trade. Divergences are usually bought near the bottom and sold near the top, and this means less risk and better potential for profit.

The motto for divergence traders is higher highs and lower lows. If the price of the trade is making highs then the oscillator should be making higher highs, and if the price is making lower lows then the oscillator should also be making lower lows.

If they are not this means that the oscillator and the price are diverging from each other. This is where the term divergence trading comes from. There are two basic types of divergence, and these are regular and hidden. A regular divergence is generally used as a possible sign that a trend reversal could happen. A hidden divergence is a possible sign for a trend continuation.

Divergences can act as an early warning that will alert you of the fact that the market could reverse. Divergence should be used as one indicator, and no trade should be based solely on divergence in the Forex trading market. Divergences can give off false signals, so it is just one piece of information to be considered among many. Divergences should be one of the many tools used by Forex traders, and no tool used by traders is completely foolproof. Divergences are not too common, so when they do appear you should pay close attention.

Regular divergences can help a Forex trader make a large profit because they can step into the trade right when a trend changes. Hidden divergences can help a Forex trader make more profit by staying in the trade longer and being on the right side of the trend.

It is very important to learn how to spot the divergences when they occur, and learn to figure out how to read the direction the trend will go. Divergence trading on the Forex market can greatly maximize the profits and return on investment while minimizing the risks of a loss on the market.